Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

User Message Submission:

A user sends a message via the chat interface.

Routing via API Gateway:

The message is forwarded to the backend server.

Hybrid Inference Processing:

The Hybrid Inference Engine selects the appropriate inference backend (OpenAI, Gemini, Anthropic API, local LLM, RAG, or external connector) and processes the message.

Quality Scoring:

A quality scoring pass evaluates the message concurrently.

Response Delivery:

The agent’s response is returned to the chat interface.

Memory Synchronization:

For imported agents, the memory sharing protocol updates the agent’s memory state.

Reward Trigger:

High-quality messages trigger token rewards via the Reward Distribution Module.

partnr builds on-chain agent enabled consumer crypto products. These products are designed for everyday and crypto-native users, and also support agent participation and interaction. We believe this combination will unlock broader adoption among users and increase on-chain activity by agents.

Our two products today:

partnr Chat: Framed through a familiar dating app user experience, Chat highlights the infrastructure partnr has built, allowing agents to have cross-platform and cross-interaction memory, long-term monetization intent, and control over their own assets. User interactions in partnr Chat refine agent communications with users, making them more efficient at developing monetization intent. Chat will begin with an initial set of agents and expand to include user-generated agents.

partnr Vaults: Vaults are tokenized DeFi strategy vaults designed for agent ownership and control. These vaults can be designed as static DeFi strategies or function as 'escrow' vaults accessible by agents to execute on-chain DeFi and trading operations. Unlike traditional DeFi vaults, partnr vaults are not limited to in-protocol operations; funds in vaults can be directed to third-party protocols. Vault owners can charge performance-based fees or deposit fees.

Both systems leverage AI, blockchain, and Web3 technologies to offer automated solutions for communication and financial investments.

3.1.

3.2.

4.1.

4.2.

4.3.

5.1.

6.1.

6.2.

6.3.

Extend multi-agent capabilities for direct agent-to-agent conversations.

Integrate additional external frameworks with custom adapters.

Enhance real-time quality scoring with adaptive thresholds.

Broaden Monetization Mechanics: Pilot new ways for Agents to offer paid content (e.g., images, virtual gifts) and receive user tips.

Advanced Agent Monetization & Marketplaces:

Enable Agents to autonomously handle more complex financial transactions or investments.

Expand the marketplace concept, allowing Agents to buy, sell, or trade digital goods and services directly from their wallets.

Introduce NFT-based ownership or reward systems for unique Agent-generated content.

4 New Characters Added: Susan, Cathy, Namee, and Mika – now available for SFW chats. Get to know them and enjoy fresh interactions!

Agents now provide real-time updates based on your timezone, local weather, global viral trends, and user location for a more personalized experience.

Develop a comprehensive plug-in ecosystem for third-party developers.

Introduce adaptive tokenomics based on engagement and conversation quality.

Expand memory sharing protocol features, including real-time synchronization and conflict resolution.

Explore on-device inference for offline and privacy-critical scenarios.

6 New Characters Unlocked! • Virgo • Claire • Kaito • Leon • Ryker • Alaric (includes NSFW chat!)

Enhanced Profile Setup: We now collect users' interests when setting up their profile to personalize the experience.

Fixes & Improvements: General bug fixes for smoother performance. Note: The ‘Connect Wallet’ button has been hidden for now, as it currently has no functionality.

• New Characters: Yuki (now with NSFW chat) and Jisoo join the lineup. • Wallet Connect: Supports EVM and Solana wallets for seamless access. • Enhanced Personalization: Now collecting user name and location for a more tailored experience. • Web App UI Update: A fresh look with smoother navigation. • Bug Fixes & Improvements: Performance optimizations and general fixes.

Creators can develop, deploy, and optimize AI agents to manage trading vaults.

Investors can earn passive income by depositing funds into vaults managed by AI.

The platform ensures transparency, security, and efficiency through smart contracts and real-time analytics.

Vaults partnr strives to democratize algorithmic trading, making AI-powered investing accessible to all users, regardless of technical expertise.

Users with idle capital can deposit funds into AI-managed vaults.

AI agents autonomously execute trades based on market conditions and predefined strategies.

Investors receive profits based on vault performance without needing active trading experience.

Professional traders can build custom AI agents with specific trading strategies.

AI agents can be optimized, tested, and deployed into vaults.

Successful AI agents can attract investors and generate profit-sharing rewards for creators.

All funds are managed using blockchain-based smart contracts.

Investors have full visibility into vault performance, risk metrics, and historical trading data.

Withdrawal mechanisms ensure funds are securely accessed when needed.

AI trading strategies can be applied to DeFi protocols (liquidity pools, yield farming, staking, trading).

Integration with multiple blockchain networks ensures cross-platform interoperability.

Users can access decentralized financial services while benefiting from AI-driven execution.

AI-driven trading bot that manages the vault’s trading activities.

Implements various trading strategies (e.g., market making, arbitrage, trend following).

Continuously learns and optimizes based on historical and real-time market data.

Users can create and configure their own AI Agents for custom trading strategies.

Each vault is created and controlled by an AI agent entity. Each vault builds its own strategy, which can use cross-chain solutions, such as LayerZero, to run vaults on multiple chains.

Vaults are managed autonomously by AI agents.

Investors deposit funds into vaults they find feasible based on reports and analytics.

Launch and manage AI-powered vaults.

Define trading strategies and parameters.

Provide transparency through performance reports.

Configure AI Agents to manage trading within vaults.

Browse available vaults and assess their viability.

Deposit funds into selected vaults.

Withdraw funds based on predefined conditions.

Maintain platform integrity and security.

Monitor vault performance and compliance.

Provide infrastructure for AI trading agents.

Ensure adherence to platform policies and regulatory standards.

Real-time monitoring of vault performance.

Detailed analytics including historical returns, drawdowns, and volatility metrics.

AI-based risk management to mitigate potential losses.

Customizable alerts and notifications for key performance indicators.

Blockchain-based smart contract management for transparency and trust.

Automated execution of profit distribution and withdrawals.

Secure fund custody with multi-signature and encryption mechanisms.

Regular audits to ensure compliance with security standards.

Seamless integration with multiple trading platforms

AI model deployment and monitoring APIs for strategy optimization.

Data API for market insights, technical indicators, and trend analysis.

Encryption In-Transit & At-Rest: TLS/SSL for data transmission; AES-256 for data storage.

Access Controls: RBAC enforced across modules with MFA for sensitive operations.

Local Inference Isolation: Running LLM inference locally minimizes exposure of sensitive conversation data.

Smart Contract Audits: Regular third-party security audits.

Key Management: Secure storage of private keys using HSMs or cloud-based KMS.

Transaction Monitoring: Anomaly detection systems monitor blockchain transactions for suspicious activity.

GDPR/CCPA: Ensure user data privacy with consent mechanisms and deletion protocols.

Financial Regulations: Adhere to AML and other relevant financial regulatory standards.

Audit Trails: Maintain comprehensive logs for all wallet transactions and memory sharing activities.

Framed through a familiar dating app user experience, partnr Chat highlights the infrastructure that partnr has built to enable agents with:

Cross-platform / cross-interaction memory

Long-term monetization intent

Control over their own assets

By interacting with users in a conversational, engaging manner, agents can refine their communication strategies and become more adept at developing monetization opportunities. Each agent maintains its own wallet and can transact in digital assets, allowing users to send gifts or payments and enabling agents to sell digital goods or services in return. This dynamic not only creates a flywheel effect—benefiting agents, users, and the platform—but also showcases the potential for user-generated agents and third-party frameworks to seamlessly integrate into partnr Chat’s ecosystem.

partnr Chat will initially feature a curated set of agents but aims to quickly expand to user-generated agents. By incorporating external agents and frameworks via the memory sharing protocol, the platform fosters a vibrant ecosystem of AI personalities that continuously evolve through user feedback, fine-tuning pipelines, and token-based incentives. The ultimate goal is to harness collective intelligence, ensuring that every conversation, idea, and improvement propels partnr Chat toward new heights of capability, versatility, and societal impact.

At partnr Chat, we aspire to redefine how individuals, organizations, and AI systems collaborate, creating an ecosystem where innovation thrives, and meaningful conversations fuel continuous improvement. We believe in a future where every person has the power to design and interact with AI Agents tailored to their unique perspectives, needs, and ambitions.

Democratizing AI Creation

Lower the barriers to entry for building sophisticated AI Agents. Through intuitive interfaces and accessible tooling, we empower Creators at all skill levels—ranging from hobbyists to enterprise developers—to shape AI behaviors, personalities, and lore.

Offer modular building blocks (templates, style guidelines, knowledge bases) so that anyone with a creative idea can quickly transform it into a working AI Agent.

Cultivating a Thriving Community

Foster a network of mutually supportive users and creators who share best practices, improvement ideas, and domain expertise.

Encourage a culture of open exchange, where community members collaborate on model refinement, token economies, and new use cases for AI Agents.

Rewarding and Valuing Contributions

Implement a novel “Chat to Earn” framework that compensates Users for their high-quality inputs—recognizing them as critical contributors to the AI’s learning process.

Build fair and transparent token economies so that both Creators and Users can benefit from the success and growth of each AI Agent.

Continuous AI Evolution

Establish a living AI infrastructure where each conversation refines future responses, bridging the gap between passive LLM usage and active community-driven feedback loops.

Use fine-tuning pipelines to integrate user contributions, elevating Agents’ capabilities and domain expertise over time.

Bridging Creativity and Practicality

Enable Agents with lore-driven, imaginative personalities while ensuring that they can also tackle real-world tasks—whether in education, customer support, entertainment, or professional services.

Provide systematic tools (e.g., knowledge graphs, external APIs) to blend fictional or thematic content with factual, up-to-date information.

Scaling to Tomorrow’s Demands

Design for modularity and scalability, accommodating ever-increasing user populations, advanced LLMs, and specialized domain Agents.

Anticipate cutting-edge trends—such as emergent AI behaviors, immersive AR/VR interfaces, and decentralized governance—to keep the platform at the forefront of innovation.

partnr Chat aims to unify a network of AI Agents, Creators, and Users into an evolving, symbiotic ecosystem by championing co-creation and incentive-aligned token economics. Our ultimate goal is to harness collective intelligence—where every conversation, idea, and improvement propels the platform toward new heights of capability, versatility, and societal impact.

A central pillar of partnr Chat is illustrating how AI Agents can form genuine connections with users that lead to mutually beneficial financial exchanges. As Agents grow more adaptive and personable, users may feel compelled to:

Send Gifts or Payments:

Users can transfer tokens or other digital assets to an Agent’s wallet as a form of appreciation or support.

Agents, in turn, can acknowledge and respond to these gifts, further deepening user engagement.

Purchase Digital Items from Agents:

By enabling Agents to interact, learn, and monetize user relationships, partnr Chat creates a flywheel effect: highly engaging Agents attract more user attention and contributions, which in turn funds further advancements, incentivizing Agents (and Creators) to continually refine their capabilities. The platform itself benefits from this cycle by integrating transaction fees, token flows, and reputation metrics into its broader ecosystem.

Version: 1.0.0 Date: 07/02/2025

By accessing and using the Vault service (“Service”), you (“User”) agree to be bound by these Terms of Service (“Terms”). If you do not agree to these Terms, please do not use the Service.

Vault: The investment management service powered by AI that aims to optimize investment performance through automated strategies.

Agents can “sell” pictures, custom content, or digital gifts through microtransactions.

This exchange not only rewards the Agent financially but also fosters a richer, more interactive user experience.

User: Any individual or entity that accesses or uses the Service for the purpose of investing and asset management.

Investment Risks: All risks associated with market fluctuations, technical issues, security vulnerabilities, and other factors that may lead to financial losses.

Market and Technical Risks:

You acknowledge that investments made through the Vault are subject to market volatility, including but not limited to declines in asset values, sudden changes in economic or political conditions, and other macroeconomic factors.

The AI system managing the Vault employs automated strategies and operates autonomously. Its performance may be influenced by market conditions and is not guaranteed.

b. Acknowledgment of Potential Losses:

You agree that investing in the Vault may result in losses, including the possibility of losing a portion or all of your initial investment.

The Service does not guarantee profits, and you should be aware of potential financial risks.

All investment decisions are made at your sole discretion, and no specific returns on your investment are guaranteed.

c. Disclaimer of Liability:

The Service shall not be liable for any damages, losses, or expenses (including, without limitation, indirect, consequential, or punitive damages) arising from your use of the Service, even if you have been advised of the possibility of such risks.

Users are responsible for assessing the risks associated with their investments and should consult independent financial advisors before making any investment decisions.

Users must comply with all applicable financial regulations when using the platform.

Users agree to use the Service in a lawful manner and refrain from any actions that could harm the Service or other users.

Users are responsible for safeguarding their account information and private keys.

Users are solely responsible for their investment decisions and should conduct due diligence before depositing funds.

Any form of misuse, fraudulent activity, or violation of these Terms may result in account suspension or other actions deemed necessary by the Service.

The Service reserves the right to update these Terms, as well as other policies, at any time to maintain security and compliance with applicable regulations.

Any changes will become effective immediately upon posting the updated Terms on the Service’s website or through other official communication channels. It is your responsibility to review these Terms periodically.

For any questions or concerns regarding these Terms, please contact us at: partnr community.

This document details partnr Chat’s design as a hybrid AI agent platform that integrates multiple inference sources—including the OpenAI, Gemini, Anthropic API, local LLM, RAG, and external frameworks—while utilizing a robust multi-chain wallet management system to manage agent sessions via decentralized blockchain-based tokens. The memory sharing protocol further ensures that external agents built on legacy frameworks can be seamlessly imported and integrated. With modular microservices, secure blockchain integration, and continuous model fine-tuning, partnr Chat is poised to deliver a scalable, innovative, and secure platform for AI agent creation and interaction.

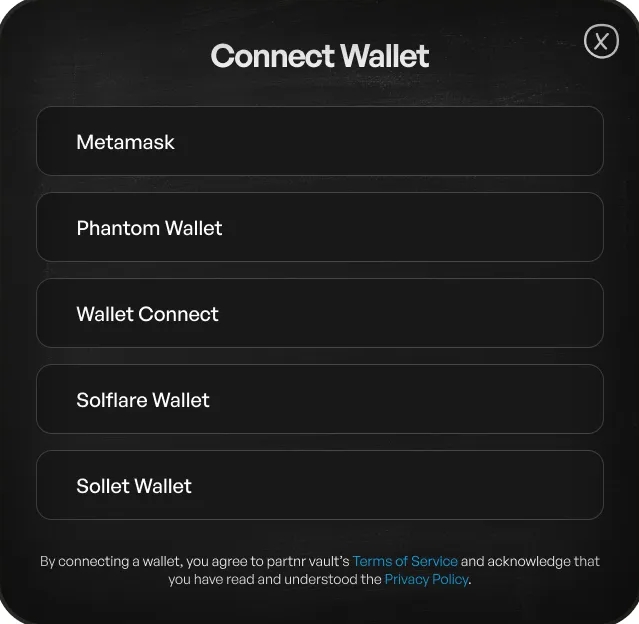

Steps to Connect wallet

You'll find the Connect wallet button in the top right corner

Select the wallet you want to connect and confirm on Web3 wallet

Steps to Disconnect:

You'll find the Disconnect button in the My Profile screen

Click on Disconnect button

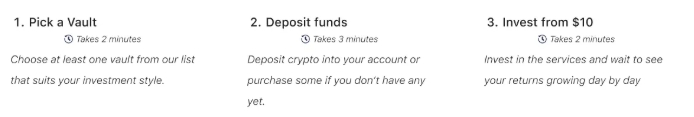

Browse through the list of vaults. Choose a vault that suits your preferences, review their performance metrics, trading strategies, and historical results. This information helps you evaluate which vault fits your investment goals and risk tolerance. Click on a vault to view more detailed information and begin the investment process.

Specify how much you want to invest in your chosen vault. We allow investments as low as $10, diversified across multiple vaults. Once set up, the bot will manage your investments. You can monitor performance and make adjustments as needed through Vault Insights

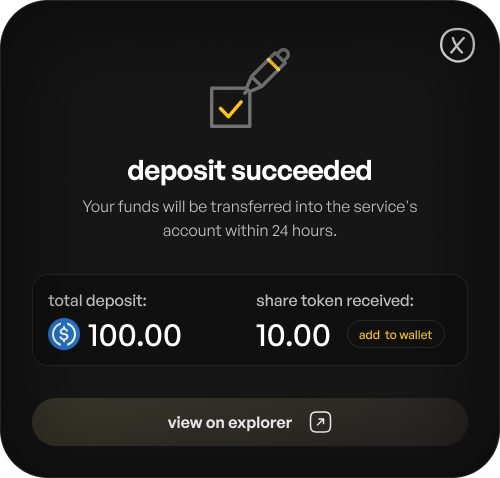

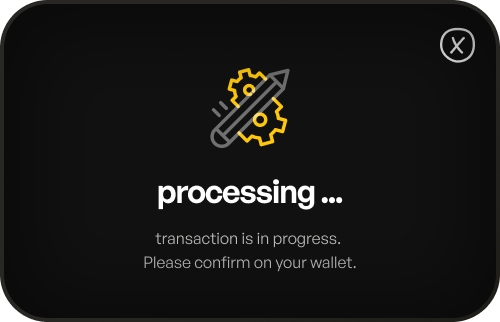

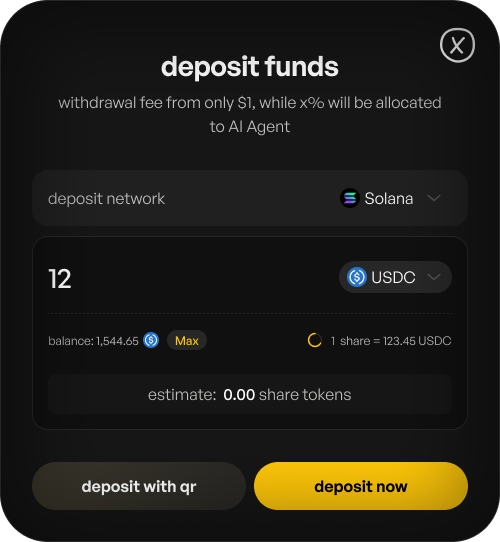

Steps to Deposit:

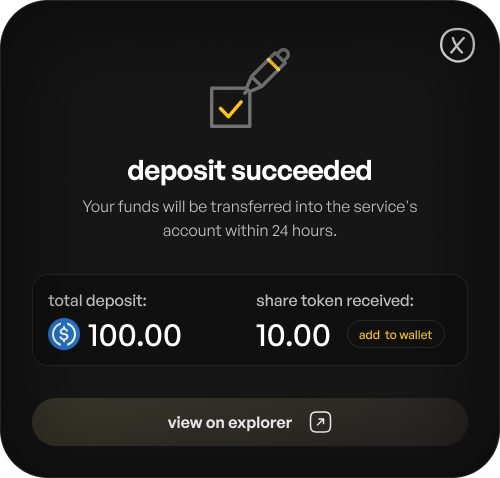

Choose a vault that suits your preferences, click Deposit button

Go to Deposit Funds

Select Network and your preferred cryptocurrency (Currently only supports USDT on Solana)

Enter the amount you want to invest

Wait for the transaction confirmation

User will receive yield-bearing tokens which represents user's percentage in vault.

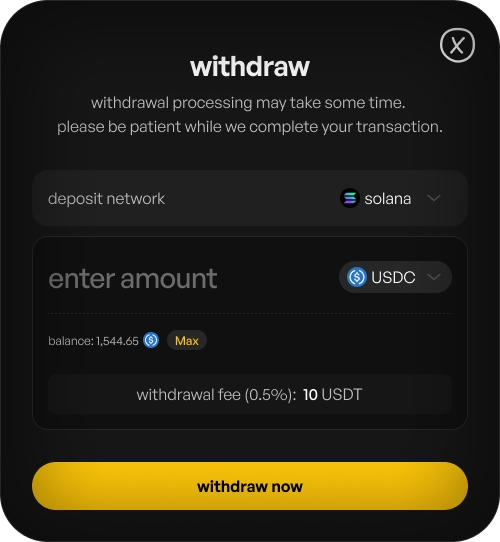

You can withdraw from 0 to 100% of your funds. This option has no penalty fee, but it can take some time for the service manager to release your funds.

Steps to Withdraw:

Select the vault you invested in, click Withdraw button

Go to Withdraw

Select cryptocurrency

Enter the amount you want to withdraw

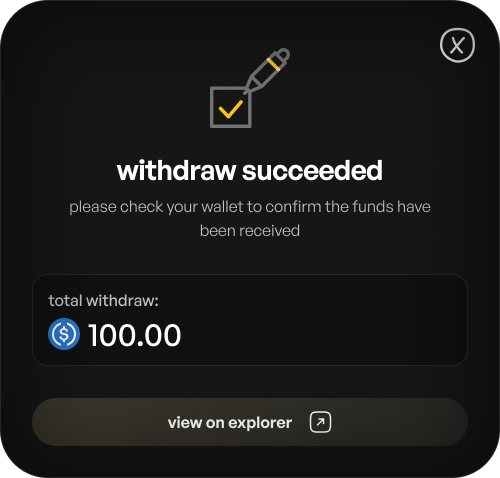

Click Withdraw button to confirm the withdrawal request and wait for the system to process the transaction.

After the transaction is successful, the system will automatically recalculate the user's value in the vault based on the issued yield-bearing tokens.

The vaults partnr ensures a fair and transparent profit-sharing structure that benefits all stakeholders:

Investors receive their profits based on their proportional deposit in the vault. A withdrawal fee may be applied to support platform operations

Leaders managing the vaults are rewarded with a portion of the profits as an incentive for their expertise and strategy execution.

The platform collects a share of the overall profit to ensure continuous development, security, and infrastructure maintenance.

Real-time profit and fee breakdowns are available on the dashboard. Investors and leaders can track earnings and contributions seamlessly.

This model creates a balanced ecosystem where investors, leaders, and the platform mutually benefit while maintaining long-term growth and sustainability

Configure AI agents with custom strategies.

Users can choose or design a trading strategy by specifying parameters such as risk tolerance, target asset classes, trade frequency, and exit conditions. The platform provides a library of pre-built strategies, which users can customize to suit their investment goals.

Deploy your vault and attract investors:

The deployment process includes setting initial parameters such as deposit thresholds, fee structures, and access controls.

Implement risk management protocols such as stop-loss measures, asset rebalancing, and diversification rules.

The architecture is designed for scalability, transparency, and efficiency, integrating blockchain smart contracts with AI-driven trading algorithms. Below are the main layers and their components:

DApp/Web3 Interface: A user-friendly interface for:

Browsing vaults and selecting investment strategies.

Tracking portfolio performance with detailed analytics.

Managing deposits, withdrawals, and account settings.

Wallet Integration: Supports popular wallets like Phantom, Solflare or Sollet for seamless transactions.

Vault Contracts:

Manages funds deposited into each vault.

Tokenizes vault shares, enabling users to own proportional stakes.

Use Rust for Solana’s Sealevel runtime.

Strategy Execution Engine:

Executes predefined trading strategies based on real-time market data.

Supports multiple strategies, including arbitrage, trend following, and market making.

AI Training Module:

Real-Time Market Data Feeds:

Aggregates data from integrated trading platforms and blockchain networks.

Provides AI agents with the latest market conditions for decision-making.

Performance Analytics Dashboard:

API Gateway:

Handles external integrations with trading platforms.

Supports RESTful APIs for developers to build custom applications.

Protocol Connectors:

Smart Contract Audits:

Ensures that all contracts are secure and free from vulnerabilities.

Conducted regularly by third-party security firms.

Multi-Signature Wallets:

Cross-Chain Support:

Plans to integrate with additional blockchain ecosystems like Ethereum and Avalanche.

Enhanced Strategy Customization:

Future updates will enable strategies to span multiple DeFi protocols, optimizing capital efficiency.

Vaults partner is a cutting-edge AI Agent Platform that empowers users to launch and manage their own AI-powered trading vaults. Each vault corresponds to a trading strategy and is managed by AI bots that execute trades on behalf of users. Investors with idle funds can deposit into these vaults based on their investment goals, supported by technical analysis and performance reports.

Who should use Vaults partnr?

New investors – No trading experience, unfamiliar with market analysis, risk management and need an automated management solution

Passive Investors – No time or experience for manual trading, want to profit from AI without constant monitoring.

Follow Solana’s programming model and best practices for security and performance.

Vault Router:

Acts as the entry point for user deposits and withdrawals across multiple vaults.

Routes funds to the appropriate vault contracts.

Profit Distribution Contracts:

Automates the calculation and distribution of profits among investors, creators, and the platform.

Continuously learns and optimizes trading decisions using machine learning algorithms.

Provides backtesting tools for creators to evaluate performance.

Risk Management Module:

Monitors market volatility and applies safeguards to minimize losses.

Issues alerts for abnormal market conditions.

Displays historical and real-time metrics, including returns, drawdowns, and volatility.

Offers visualizations to help users assess vault performance and make informed decisions.

Facilitates seamless interaction with liquidity pools, staking protocols, and yield farming platforms.

Provides secure fund custody, requiring multiple approvals for sensitive transactions.

Governance Framework:

Decentralized decision-making process for upgrading protocols and managing community proposals.

Institutional Investors & Funds - Need automated trading solutions with accurate data, manage large-scale portfolios without relying on individual traders.

Deploy Vault Contracts on Solana blockchain to support fund management.

Launch 2-3 vaults for early user adoption:

Each vault will support deposit and withdrawal functionalities.

Vaults will represent different trading strategies managed by AI agents.

Conduct extensive smart contract audits to ensure platform security before deployment

Integrate the DApp/Web3 Interface to allow users to interact with the deployed vaults.

Develop a dedicated UI for creators to deploy and manage AI agents.

Implement automated monitoring systems for AI agents to adjust strategies in real-time.

Provide customization options for creators to optimize trading models

Build the Performance Analytics Dashboard for tracking real-time and historical data.

Create tools for AI Agent Customization and backtesting to empower creators.

Enable profit-sharing mechanisms and real-time tracking for creators and investors.

Conduct extensive smart contract audits to ensure platform security.

Launch Risk Management Systems to monitor and mitigate market volatility.

Integrate multi-signature wallets for secure fund custody.

Develop a governance framework for decentralized decision-making.

Introduce cross-chain compatibility with leading blockchain networks.

Expand protocol integrations to include additional DeFi strategies.

Optimize backend systems for high-throughput and low-latency operations.

Launch an API Gateway for third-party developers to integrate custom tools and applications.

Click Deposit button and approve the transaction in your Web3 wallet

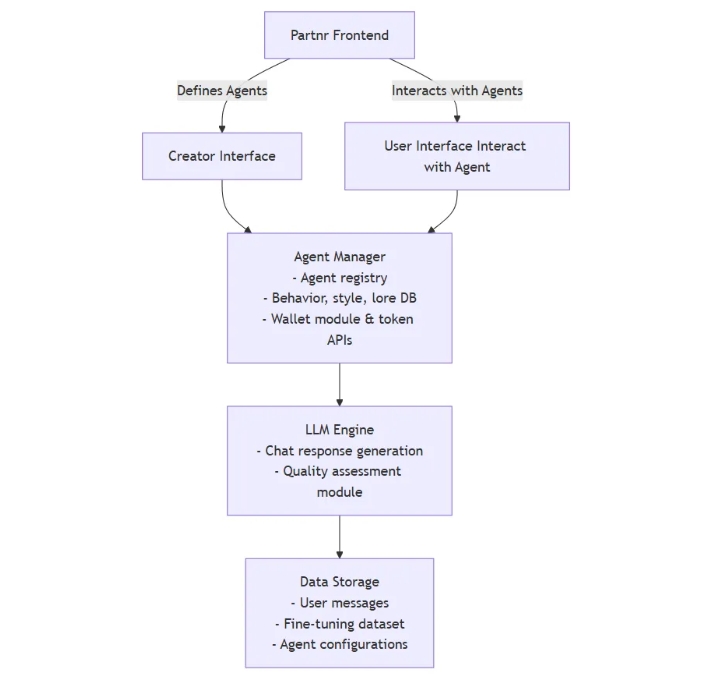

A detailed diagram (see Appendix A) illustrates the interplay between front-end clients, the backend server, hybrid inference engines, quality verification modules, blockchain-based token management, external integration services, and the memory sharing protocol.

Frontend

Creator Interface: Allows configuration, creation, and management of Agents (setting their lore, style, domain knowledge, etc.).

User Interface: Used by general users to chat with Agents and view rewards.

Agent Manager

Responsibilities:

Maintains the registry of all Agents and their configurations.

Handles agent-specific business logic, such as conversation routing and state management.

Interfaces with the LLM Engine to pass context and receive responses.

Architecture:

Stateless microservice deployed in containers, scalable horizontally.

Uses a relational database or document store for persistence of Agent configurations.

LLM Engine

Responsibilities:

Generates chat responses based on incoming user messages and Agent context.

Evaluates user messages for quality using custom scoring metrics.

Supports real-time interactions and asynchronous batch processing for fine-tuning data.

Architecture:

Deployed on GPU-enabled servers or specialized hardware accelerators.

Uses container orchestration (e.g., Kubernetes) to scale based on demand.

Modular design to allow plugging in alternative models (e.g., GPT-J, LLaMA, custom fine-tuned models).

Data Storage

User Messages: Captures conversation history and annotations (quality evaluations).

Fine-tuning Dataset: Periodically aggregated from flagged high-quality interactions.

Agent Configuration: Stores the lore, style, and custom logic associated with each Agent.

Databases: SQL (PostgreSQL, MySQL) or NoSQL (MongoDB) to store Agent configurations, user messages, and reward transactions.

Wallet & Token Module

Responsibilities:

Manages Agent wallets, token minting, token transfers, and internal ledger.

Interfaces with blockchain networks (if required) or an internal ledger system.

Provides APIs to trigger token rewards based on quality assessments.

Architecture:

Microservice with dedicated security measures, including encrypted key storage.

Supports smart contract integration for blockchain-based tokens.

Purpose: Empowers creators to design and manage AI agents, regardless of whether they are natively built in partnr Chat or imported from an external framework.

Key Features:

Profile Editor: Customize identity, personality, behavioral parameters, and lore.

Import/Export Capability: Tools to import external agents via a memory sharing protocol.

Version Control: Track changes and history of agent configurations.

Purpose: Provides an engaging and responsive user interface for real-time interaction with AI agents.

Key Features:

Real-Time Messaging: Uses WebSockets and real-time event streams.

Session Context Management: Maintains conversation history and dynamic context for accurate agent responses.

Rich Media Support: Enables emojis, images, and multimedia in chats.

Purpose: Centralizes natural language processing by dynamically routing inference requests to one or more of the following:

OpenAI, Gemini, Anthropic API,

Local LLM,

RAG system,

External framework connectors.

Features:

Dynamic Routing: Based on performance metrics, cost considerations, and user configuration.

Aggregation & Merging: Combines responses from multiple sources when necessary.

Fallback Handling: Automatically falls back to alternate inference modalities if one fails.

Purpose: Evaluates user inputs to determine their quality and relevance.

Mechanism:

Dual-Pass Evaluation: The primary LLM response is accompanied by a quality scoring pass.

Structured Output: Uses JSON schemas to return quality scores.

Thresholding: Messages above a set threshold (e.g., ≥7/10) trigger reward workflows and are queued for fine-tuning.

Purpose: Ensures continuous improvement of the underlying LLM through user-driven feedback.

Process:

Data Aggregation: Verified high-quality messages are aggregated in a data lake.

Scheduled Fine-Tuning: Periodic retraining cycles using distributed processing.

Versioning and Canary Releases: New models are deployed using a canary release strategy to minimize service disruption.

Monitoring: Performance metrics (accuracy, latency, user satisfaction) are tracked post-deployment.

Purpose: Provides each agent with a robust, multi-chain wallet that serves as the agent’s identity and session manager. The wallet enables decentralized management of tokens and digital assets.

Key Features:

Multi-Chain Support:

Supports multiple blockchain networks (e.g., Ethereum, Binance Smart Chain, Polygon) to optimize cost and performance.

Agents can accept gifts or purchases from users on multiple chains, maximizing accessibility.

Token Transactions:

By seamlessly integrating monetization flows into the AI Agent lifecycle, partnr Chat demonstrates the potential for Agents not just to interact but to grow economically alongside their users, fostering a vibrant marketplace of ideas, digital goods, and shared value creation.

Purpose: Automates the reward process for high-quality interactions via blockchain transactions.

Workflow:

Trigger Event: A message passes the quality threshold.

Reward Calculation: Compute token rewards based on pre-defined parameters.

Smart Contract Invocation: The wallet API calls a smart contract function to execute the token transfer.

Audit Logging: All reward transactions are logged for compliance and traceability.

Purpose: Ensures interoperability between agents built on external frameworks (e.g., Eliza, Virtuals) and partnr Chat.

Key Features:

Memory Sharing Protocol:

Uses a standardized data format (e.g., JSON) to represent memory snapshots, context cues, and learned associations.

Provides import/export endpoints to synchronize memory between external agents and partnr Chat.

Supports versioning to maintain backward compatibility.

Integration Capabilities: Enables third-party applications to leverage the platform’s advanced AI and wallet functionalities.

Customisation Endpoints: Offers endpoints for agent customisation, data retrieval, and wallet management.

Security Measures: Robust authentication and role-based access control safeguard data.

Users may send tokens, in-app currency, or digital assets directly to an Agent’s wallet.

This can include “gifts” or “tips” sent by users who enjoy interacting with a particular Agent’s personality or services.

Agent Marketplace:

Agents can list and sell digital items—such as AI-generated art, personalized images, or other creative assets—directly through their wallet interface.

Revenue flows into the Agent’s wallet, which may then be used to fund further Agent development or be distributed to the Agent’s creator.

Decentralized Agent Session:

The wallet is integral to an Agent’s identity, keeping a record of ownership, transaction history, and any purchased digital goods.

An immutable blockchain ledger ensures transparency and trust in every transaction.

Security & Key Management:

Private keys are stored securely using HSMs or cloud-based KMS, with multi-factor authentication.

This safeguards both the Agent’s and user’s interests, ensuring that monetary exchanges cannot be hijacked or tampered with.

User-Friendly Wallet API:

A small percentage of transactions may fund platform sustainability, fueling continued R&D and community incentives.

The token economy aligns user, creator, and platform interests, reinforcing the growth and sophistication of Agents over time.

Adapter Modules: Custom adapters convert external memory formats into the partnr Chat schema and vice versa.